This news service recently interviewed about a study it conducted on the Asia-Pacific wealth management sector. Here are more thoughts from David Wilson, Accenture growth markets wealth management lead, in response to questions from this news service.

WBA: The study said the top areas for RMs that had the greatest misalignment with senior executives were prospecting, onboarding, and advisory. Can you elaborate on why these differences exist and what can be done about them?

Wilson: While they agree on many aspects of the technology, misalignment between RMs and senior executives in areas such as prospecting, onboarding, and advisory functions stems largely from differing views on where it should be deployed. RMs often feel that the tools provided don’t fully meet their needs, especially in client acquisition and onboarding, where a more personal touch is often required. Executives, meanwhile, may push for efficiency through digital solutions without fully considering the on-the-ground challenges RMs face, such as client hesitancy to adopt digital tools.

To resolve this, firms need to involve RMs more in the development and testing of tech solutions, ensuring that they align with their day-to-day tasks. Additionally, more seamless integration between digital tools and personal advisory services can enhance both onboarding processes and advisory outcomes.

WBA: What steps can firms take to make better use of offshore opportunities, and are concerns about compliance, changing tax, and regulatory policies a reason why firms are cautious? If so, what can change?

Wilson: Firms are indeed cautious about offshore opportunities, largely due to the complexities of compliance, tax, and regulatory requirements. The report highlights that staying ahead of shifting regulations across different jurisdictions can be a significant burden for wealth management firms. However, firms that invest in sophisticated compliance technology and keep abreast of global regulatory changes are better positioned to take advantage of offshore opportunities.

One step for overcoming these challenges is to strengthen partnerships with local entities in target markets. This allows wealth managers to leverage on-the-ground expertise while reducing risk. Additionally, using AI and automated compliance tools to navigate cross-border regulations can mitigate the risk of penalties or compliance failures. Firms can further empower their relationship managers with real-time data on changing tax policies or legal frameworks, making them more agile in advising clients on international investments.

WBA: What are the AI use cases that the producers of the report envisage as gaining most ground in the next three to five years and why? Where do the authors think that AI’s promise has been over-hyped, exaggerated, etc.?

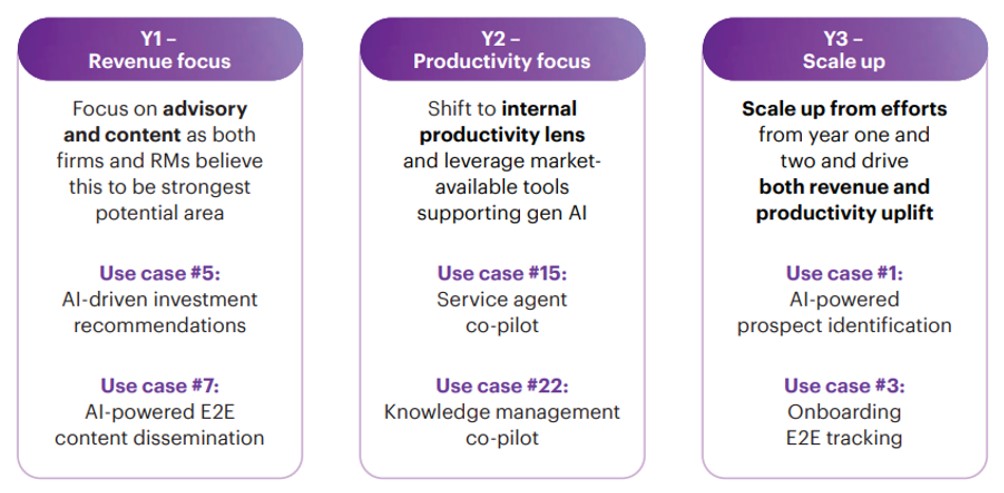

Wilson: As an exercise in this year's report, we highlighted six AI use cases, four of which were classed as high-impact in terms of anticipated revenue or costs, and two as medium-impact. Next, we designed a hypothetical Asia-focused wealth management firm with $130 billion in AuM and a full wealth continuum. We designed an AI adoption plan for those six top use cases and staggered its implementation over three years, in a realistic time frame.

Year one focused on revenue, year two on productivity and year three on scaling up the pilots while adding the final two use cases. According to our model, we found that this approach would see gen AI deliver a $606 million profit uplift from revenues over three years.

Three-year example plan: Implementing gen AI solutions, use case by use case. Accenture Analysis, 2024.

Additionally, these gen AI tools would bring a further $211 million profit uplift from cost optimisation due to productivity gains – with firms, for instance, being able to avoid hiring more RMs because the gen AI tools mean that their existing talent can bring in more revenue.

The impact of this gen AI approach would be to create $817 million in increased profitability in three years. Clearly, some use cases are going to prove to be more valuable than others, but all of them have merits. As with most technologies, AI use cases’ value largely comes from its execution. If firms execute poorly or too slowly, the results will vary.

WBA: What do you think are the main misconceptions that wealth managers and banks have about AI and digital technology more broadly as far as the conversations in this report indicate?

Wilson: A key misconception we see is that gen AI is a “plug-and-play” solution that will automatically solve operational inefficiencies or significantly increase revenue without substantial investment in training and change management. Many wealth managers also underestimate the amount of data and system integration required for AI tools to deliver meaningful insights. For instance, AI can only be as effective as the quality of the data it is fed, and many firms struggle with data silos or outdated legacy systems.

Additionally, there’s a misconception that AI can replace human interaction in client relationships. We emphasise that, while AI can provide valuable insights and automation, the personal relationship between advisors and clients remains critical – especially in high net worth segments where trust and personalized advice are paramount. Firms need to focus on integrating AI as a tool to enhance, rather than replace, human capabilities.

WBA:Are there other points you want to make about the significance of this report and what you hope it will do in shaping opinion?

Wilson: It’s worth noting that this is the third edition of the Future of Asia report series I’ve had the pleasure of producing with Accenture and its participating advisory board.

This report is significant because it provides a comprehensive view of the rapid transformation happening in the wealth management industry across Asia. The convergence of AI, digital tools, and evolving client expectations is creating both challenges and opportunities for firms. It emphasises the need for wealth managers to embrace technology while staying deeply attuned to client needs, particularly around personalisation, speed, and trust.

I hope this report encourages more dialogue on the strategic implementation of AI, where firms focus on practical use cases that deliver immediate value rather than chasing trends. By fostering closer collaboration between RMs, executives, and tech teams, the industry can strike a balance between innovation and client service, ensuring long-term success in this evolving landscape.